While seaching for more income research I stumble across a reference to Census and Fed reports about income and wealth at independentsources.com but they link to johnbatchelorshow.com which is copy of an op-ed piece from The Wall Street Journal. (Unfortunately neither site links to the actual reports.) But this quote from the op-ed caught my eye:

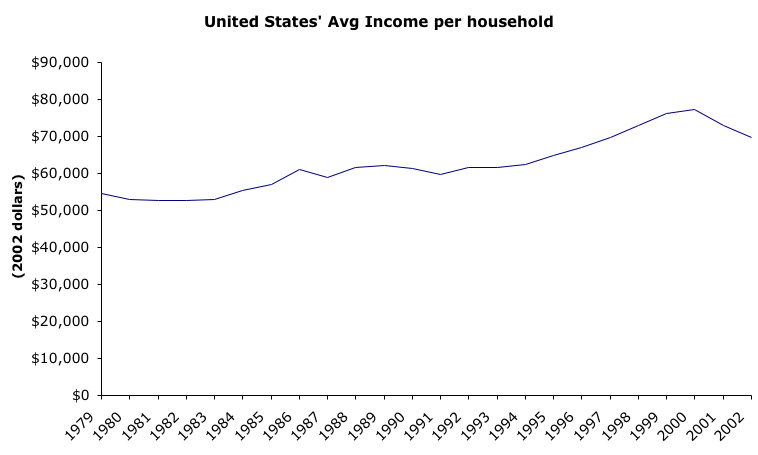

Back in 1967, the income range for the middle class (i.e., the middle-income quintile) was between $28,000 and $39,500 a year (in today's dollars). Now that income range is between $38,000 and $59,000 a year, which is to say that the middle class is now roughly $11,000 a year richer than 25 to 30 years ago. This helps explain why middle-income families can buy things like cable TV, air conditioning, DVD players, cell phones, second cars and so on, that were considered mostly luxury items for the rich in the 1950s and '60s.

The upper-middle class is also richer. Those falling within the 60th to 80th percentile in family income have an income range today of between $55,000 and $88,000 a year, which is about $24,000 a year higher than in 1967. This rapid upward income mobility indicates that the great American Dream, in which each generation achieves a higher living standard than their parents, is alive and well.

I looked at both the Census' Historical Income Tables for Households and for Families and it looks like the household data is a closer match to the data in the quote above but neither is an exact match. (Earlier I had graphed the share of family income going back to 1947 based on Census data, which is why I knew about the data tables. )

I went ahead and graphed the income ranges for the "middle class" 40-60 percentile and the "upper middle-class" 60-80 percentile mentioned in the op-ed (1967-2004), for both households and families. While the 40% and 60% lines are increasing over time it is the 80% line that is increasing the most. In other words, the higher your income the greater your increase in income.

Addendum: I am added the percentage increase for each chart Household - consists of all the people who occupy a house, an apartment or other group of rooms, or a single room occupied as separate living quarters. 40th percentile = 24% 60th percentile = 39% 80th percentile = 55%

Family - a group of two people or more related by birth, marriage, or adoption and residing together. 40th percentile = 34% 60th percentile = 52% 80th percentile = 68%

Looking at the definitions some of the differences between household data and family data could be due to an increase in two-income families.